Your Wealth deserves a strategy

A different way of looking at financial planning

Advanced Time Segmentation

Advanced Time Segmentation matches our client's assets to their income liabilities. It’s a strategy that creates inflation-adjusted income that addresses risk by giving equities time to potentially grow untouched. The approach allocates assets into different time segments based on the period when those assets are expected to generate income.

Strategy-driven Practice

Most retirees or pre-retirees with a wealth accumulation strategy, hunger for stability and are attempting to avoid risk. They strive to build their portfolio on investments that will provide income for their lifetime and beyond.

Nova Weatlh uses an approach to retirement planning that incorporates time-segmented retirement income distribution to provide investors with stability, growth, and income.

Our Strategy

Advanced Time Segmentation seeks to provide investors with stable, predictable income while giving time for future possible growth. We take principles that were exclusive to the wealthy and make them accessible to everyone. By mathematically calculating risk and inflation to adjust income, we can create a pathway towards a lasting legacy.

We implement a one-of-a-kind strategy with every portfolio so that time is always on your side.

BUILDING CONFIDENCE

A financial plan needs to focus as much attention on wealth distribution in retirement as it does on wealth accumulation during one's working years. A successful time-segmented wealth distribution plan is designed to provide the same confidence for retirees into their 90s as it did in their 60s.

ADVANCED TIME SEGMENTATION

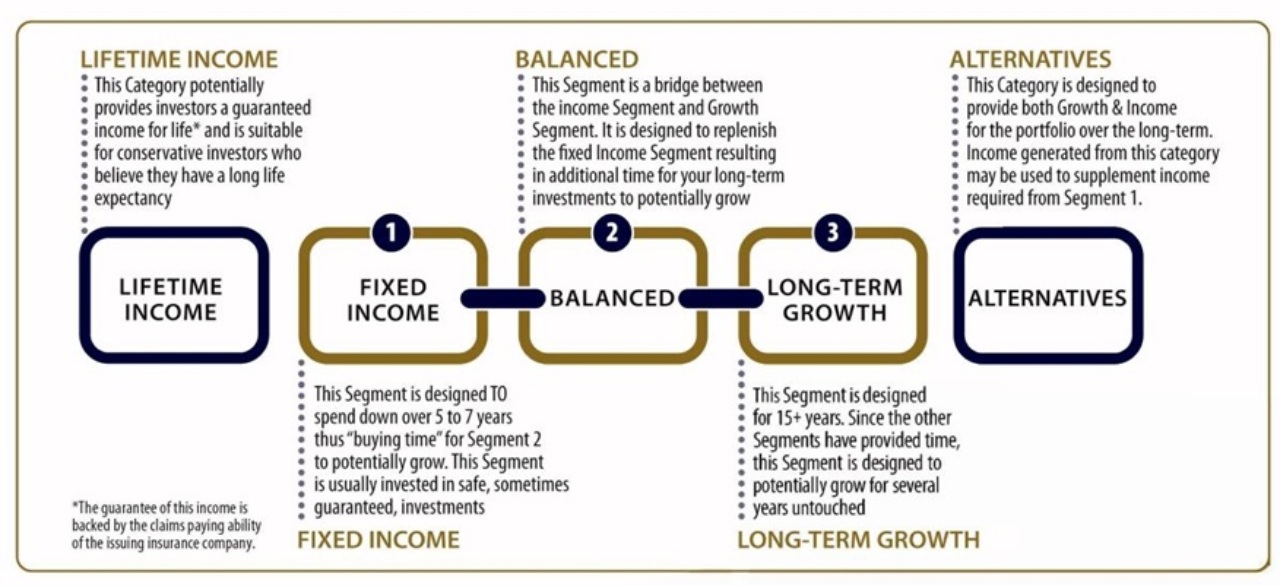

Advance TimeSegmentation is a strategy that matches unique retirement income needs with time-segmented investments. This approach segments retirement assets into certain categories. The categories are based on the time period in retirement when the assets are expected to generate income.

Time Segment #1 - Immediate Income

This segment is designed for income and is where your short-term assets are matched to your short-term liabilities. A portion of this segment is invested in vehicles designed to provide income for life. The remainder of the segment is invested in strategies designed to be spent over a five to seven-year period, buying time for potential growth in the remaining segments.

Time Segment #2- Future Income

This segment is designed to replenish the fixed-income portion of segment #1, resulting in additional time for the long-term investments in segment #3 to grow. In this segment, mid-term assets are matched to mid-term liabilities. This helps create a bridge between income in segment #1 and long-term growth in segment #3, featuring a typical time horizon of seven to ten years.

Time Segment #3- Long-term Growth

This segment is designed for long-term income and growth, with a typical time horizon of at least 15 years. In this segment, your long-term assets are matched to long-term liabilities. By withdrawing assets from segments #1 and #2, segment #3, investments can be left untouched to satisfy your long-term retirement needs.